Virginia Senator proposes bill to lower gas taxes for a year

Gas prices have increased at the pump over the last couple of years.

February 22, 2022

Senator Mark Peak proposed a bill to lower gas taxes by five cents for gas and almost seven for diesel. If the bill gets passed, it will be set in place July 1, 2022 and end July 1, 2023.

The taxes are split between the Virginia Department of Motor Vehicles(DMV) and Virginia Department of Transportation(VDOT). Virginia collected $2.86 billion in revenue in 2019 alone.

Taxes have increased by 77.78% the past seven years. In 2015, the tax was 16.2 cents per gallon. It has increased to 26.2 cents, which could be lowered to 21.2 for gas and 20.2 for diesel.

The bill could cost Virginia transportation departments around $200 million dollars. In a two year span, they could lose $186 million and more than $132 million annually after that.

Half of the gas tax goes to vehicle titling/registration, driver licensing, maintenance of driver and vehicle records which are all maintained by the DMV.

VDOT uses half to maintain highways and roads. The taxes pay for plowing and making sure the roads stay in drivable conditions after snow storms or inclement weather.

Even though VDOT is expensive to run, extra money is left over that they distribute to other programs. Some of the programs are the State Police, Department of Education, Department of Health, Emergency Medical Services, Department of Environmental Quality and the Virginia Alcohol Safety Action Program.

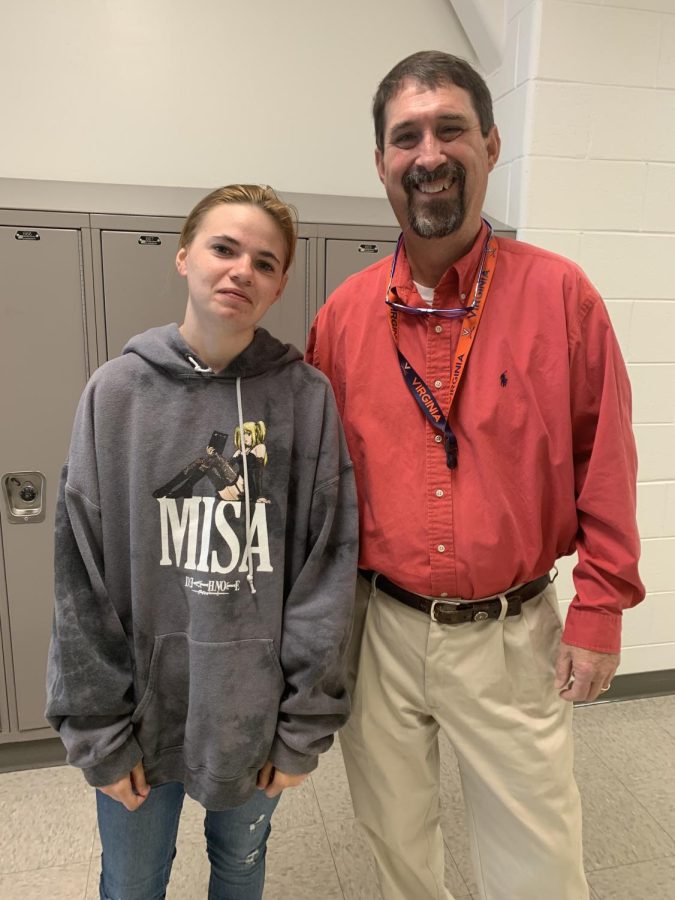

“Gas taxes are too high. The cost of crude oil and what it costs to refine it is also a problem that affects the taxes,” Economics and Personal Finance teacher John Konoza said.

Konoza went from paying around $28 to over $40 to fill up his Ford Escape, and his pickup truck also costs him over $100 for a full tank.

The prices at the pump take a toll on full time students who do not have a stable income.

“It’s hard to afford high gas taxes while going to school and not having time for a job. I went from filling up for $30 to $55,” senior Jacob Barber said.